If you decide you desire to exchange choices, realize these types of steps to get started. Work with records on the everyday alternatives frequency or uncommon interest and you can volatility to identify the new opportunities. Greeks is actually analytical computations familiar with influence the result of numerous points to the alternatives.

Discover an account and you may deposit currency

For instance, you should use a protected label so you can earn money in the an excellent sideways field. “The advantages have you been will make slightly additional money to your investing in the newest temporary,” Moyers states. “The newest ripoff is you you will eliminate everything, based on how your construction your options change.” All of the options package features a termination months you to suggests the final day you can take action the choice. Your options is actually limited by those provided after you phone call upwards an option chain.

Place alternatives will help people put a minimum rates a stock will likely be offered to possess otherwise create various downside https://madboxsolutions.com/whats-cryptocurrency-trading-as-well-as-how-can-it-works-ig-global/ barrier. View it video clips to learn more about defensive places and place spreads. To find an used causes the very least rates where the brand new investment will likely be offered for an appartment time period. That it lowest depends upon the brand new struck rate that is tend to described as a floor. Once you’ve receive a broker that fits your circumstances, you might open the newest membership and you will deposit currency.

- Either way, the fresh creator has the first $20,100000 obtained.

- The newest lay’s hit rates sets the ground where the fresh stock is also end up being sold.

- If your stock drops slightly, goes sideways, otherwise rises somewhat, your options have a tendency to expire meaningless without next obligations, according to him.

- When you’re a lot of time, you have a straight to do it the choice and you may move it so you can offers, or perhaps not.

- Since the an amateur within the alternatives exchange, you could kickstart the travel by using the brand new ‘Tips exchange possibilities’ steps below.

Approach Optimizer

That it shape reflects the newest terrible loss of $2,five hundred (twenty five x a hundred) minus the advanced made of $3 hundred. But not, if your stock cannot go above $55, your option expires meaningless and you also remove the new $2 hundred premium. Which portrays the potential advantages and you may dangers of options trading. Investors can be inclined to take winnings from the very first chance by attempting to sell their choices to your open market or exercise early. If you decide to keep until conclusion, the option both expires worthless or efficiency a profit whenever resolved to the termination time. When purchasing an alternative, it remains beneficial only when the brand new inventory rate shuts the option’s termination period “on the money.” Meaning sometimes above otherwise beneath the hit rate.

But not, there are also a lot more refined tips that can be used to return. The first step is always to multiply one to $5 from the one hundred shares the phone call alternative offer talks about. With regards to investment, you to definitely package will represent 100 offers of a specific business. This is not usually the case, yet not, and you may incidents including inventory breaks (or reverse breaks), mergers, and also the issuance from special dividends when it comes to shares can impact the brand new offer proportions. To own hands-for the investors seeking deeper freedom and handle, self-directed online systems supply the broadest accessibility. Any type of method you choose, start by an obvious investment package and you can understand how per instrument fits to your larger financial wants.

Possibilities and you may holds features similarities in the sense that should you very own an options package, you control the fresh theoretical exact carbon copy of 100 shares away from inventory rather than that have control of stock. Using an excellent margin membership ensures that no minimal balance can be applied. Yet not, you should have financing on the account that cover margin requirement of a tips package first off trade. But, when you’re planning to qualify for margin rights, you really need to have a minimum of $dos,100 on the membership. One of several differentiating items out of alternatives trading is you is also make the most of root costs you to sit within a specified diversity, not simply those that experience large upward and downward motions. Consider even if, if the inventory closes a lot more than $45 in the conclusion, the brand new buyer will have lost the whole investment from $100 paid upfront.

Fidelity Smart money℠

Business volatility close conclusion also can improve an investor’s risk of a choice not-being value something when it expires. Whenever one given day ends plus the option ends, it no longer provides worth and no extended can be found. Think you would expect Business XYZ’s stock, currently priced at $50, to rise so you can $sixty in the next month.

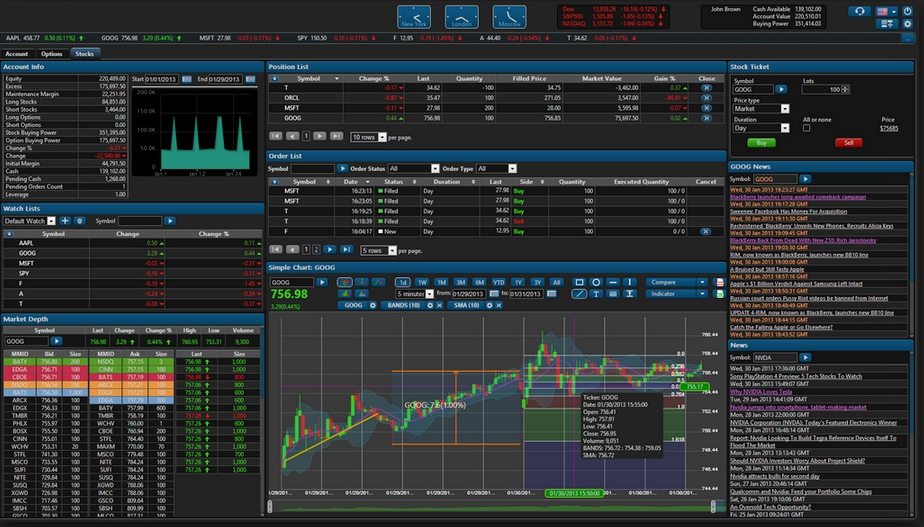

Come across ranks and construct buy seats to own business, limitation, avoid, and other requests, and much more right from our choices stores. Pre-populate the order admission or navigate to help you they to build the transaction. Utilize the Options Analyzer equipment to see possible max earnings and you can losses, break-actually accounts, and you may likelihood for your approach. “Solution trade is not suitable people, specifically novice traders,” Frederick says, pointing out you to some procedures want a substantial bills of money and lots of bring tall downside risk. Joey Shadeck ‘s the Blogs Strategist and you may Lookup Analyst to own StockBrokers.com.

Brings give simplicity, control and you may much time-label gains prospective, which makes them ideal for a selection of traders. Alternatives, when you’re harder, offer self-reliance, leverage and you will risk management products you to experienced traders may use in order to improve their profiles. Your choice is always to fall into line together with your monetary wants, chance tolerance and you can funding education. Investors can access one another brings and you may options thanks to brokerage profile, many of which offer on the web networks with research products, trade connects and you can instructional tips.

- Let’s state couple of years features enacted, and now the new developments are built and you will zoning might have been approved.

- The fresh share cost of Acme Business really does rise high within the rates as well as in 90 days offers are change to own $90.

- Adjusting to the aforementioned terms is an excellent initial step proper who wants to can trade choices.

- For example, if you buy a trip otherwise lay alternative, the most you could potentially lose ‘s the advanced your covered the possibility.

- When people combine both together with her, they have much more alternatives than once they traded holds by yourself.

- They will let you imagine on the price of a fundamental security—if this usually increase, shed, or stay a comparable.

Intrinsic well worth, along with extrinsic worth will give you the full option’s advanced. Nevertheless these two key components of options cost disagree as to what they portray. While the a beginner inside the choices change, you could kickstart their excursion by following the newest ‘Tips change choices’ actions lower than.

Have fun with options chains evaluate possible stock or ETF options trades and then make their alternatives. Despite the popularity, the fact is possibilities trading isn’t that quick and you also must be pretty tactical when taking in it. Find reduces less than just what energetic investors would like to know just before offering they a-try. There are an array of possibilities steps you could potentially discuss to apply the strategy, as well as those who trust volatility—including straddles and you can strangles. Choices on the individual brings as well as on inventory indicator are positively exchanged for the exchanges like the Chicago Board Possibilities Exchange (CBOE), which is the largest United states possibilities exchange. Choices are in addition to traded to your Western Stock market (AMEX) and you may Pacific Stock exchange (PSE).

The new investor usually recover the woman will cost you in the event the stock’s speed are at $twelve. Imagine that you want to pick technical stocks, nevertheless would also like so you can limit loss. That with set alternatives, you can curb your drawback exposure and cost-effortlessly delight in all of the upside. For short sellers, phone call alternatives can be used to limit losings if your underlying rates motions facing their change—specifically while in the a great quick fit. Binary choices offer investors a couple of choices — a certainly-or-no proposition — on the a particular consequence of an event. The outcome possibly goes otherwise it doesn’t, as well as the investor sometimes victories or loses.